What is diversification?

Diversification entails spreading your money across a variety of different investments with the hope that should one come under a period of poor performance, the others can help offset the losses. The idiom of ‘not putting your eggs all in one basket’ describes the notion of diversification perfectly.

The core goal of diversifying an investment strategy is to reduce the non-systematic or idiosyncratic risk of the portfolio. These risks typically only affect individual securities or a specific asset class rather than capital markets on aggregate.

An example of a non-systematic risk could be a company scandal. It would be very unlikely for a single scandal to weigh heavily on global markets, although the company in question’s stock price could experience significant volatility.

While in certain climates a high conviction strategy – with a relatively small number of investments – may outperform, having a portfolio with a range of asset classes across a variety of geographies should add a degree of robustness to the portfolio. The returns should also be more stable over the longer term. A portfolio with a range of assets, some of which will have little or even negative correlation, should provide a source of protection against macroeconomic shocks.

Top tips to diversify

A suitable asset allocation

Having a sensible target asset allocation is perhaps one of the best ways to diversify an investment portfolio to suit your risk tolerance. Asset allocation is the process of splitting your investment over a series of asset classes with the aim of aligning the portfolio with your risk appetite.

This allocation can be organised, at a high level, with an investment that may be split across major asset classes such as equities or bonds. If you’re a more experienced investor, you may go more granular with your asset allocation, allocating in areas you find particularly attractive.

It’s widely believed that the asset allocation of a portfolio is one of the most fundamental drivers of long term returns for you as an investor, hence implementing a suitable one is critically important. Essentially, there isn’t one-size-fits-all solution for all in terms of what an ideal asset allocation looks like.

The most important thing for you is to choose an allocation that enables you to sleep at night and not constantly worry about short-term fluctuations in the value of your investment.

When considering asset allocation, there are two predominant strategies investors tend to utilise. Strategic asset allocation is agnostic to potential economic fluctuations and shocks, enabling it to be kept the same throughout the investment lifetime.

It’s often combined with a tactical asset allocation, which is where you’ll change your asset allotment based on macroeconomic risks or changes in valuation.

For example, as an investor you may wish to tactically reduce your US equity exposure for a temporary period, if you feel that the region is overvalued. Our Smart Portfolios make use of a robust strategic asset allocation that we make tactical changes to on a periodic basis as we see fit – to optimise our client’s returns. The pie chart shows an example of asset allocation, which represents a quintessential balanced multi-asset portfolio.

Add non-correlated assets to the mix

Another essential strategy that can boost long term risk-adjusted returns and potentially lower the risk of a portfolio is to look for assets that either have very little correlation, or even better – a negative correlation. Assets with a strong positive correlation (more than 0.6) tend to move in tandem with each other, while assets with a strong negative one (less than -0.6) often move in the opposite direction.

While this may seem fundamentally counterintuitive when all areas of the market are firing on all cylinders, in times of stress and volatility, a lack of correlation can act as a lifesaver.

The chart shows the correlation between the S&P 500 and global investment grade bonds over a six-year period. Typically, the correlation has been fairly negative, but 2022 saw a sustained surge in correlation between the two asset classes. This was primarily driven by the global rise in inflation and rate hiking campaigns from central banks.

Hence, multi-asset portfolios, which were bonds and equities, heavily experienced losses from many of their positions throughout the year. This illustrates the consistent need to look for alternate sources of the uncorrelated alpha to further boost the robustness of your portfolio and bring the overall volatility and risk down over the longer term.

Below is a correlation matrix showing some of the exchange traded funds (ETFs) we use to construct our Smart Portfolios. All the ETFs track major indices extremely closely. While naturally there’ll be strong correlation between certain areas, which is simply impossible to avoid when constructing a multi-asset portfolio, certain negatively correlated assets have helped reduce the risk and increase the diversification of the portfolios.

These assets are typically alternative assets, such as broad-based commodities and physical gold, which on aggregate aren’t highly correlated with bonds and equities staple components of our Smart Portfolios.

It’s also important to remember that correlations can change over time, as they did rather dramatically in 2022. Therefore, it’s always important to review your portfolio and try to get a gauge of how correlated the securities held are and have been over a period. Consistently reviewing how diverse the correlation of the assets is will aid in the reduction of long term portfolio volatility.

Periodically rebalance your portfolio

The importance of rebalancing a portfolio either when your risk appetite changes, opportunities arise or simply just periodically cannot be overstated. Rebalancing involves bringing a portfolio, which has deviated away from its target asset allocation, back in line with its target.

This is orchestrated by selling assets overweighing the portfolio and using the proceeds to purchase assets that are under their target weight. Another method that you may utilise is adding contributions to an underweight area and taking withdrawals from an overweight one.

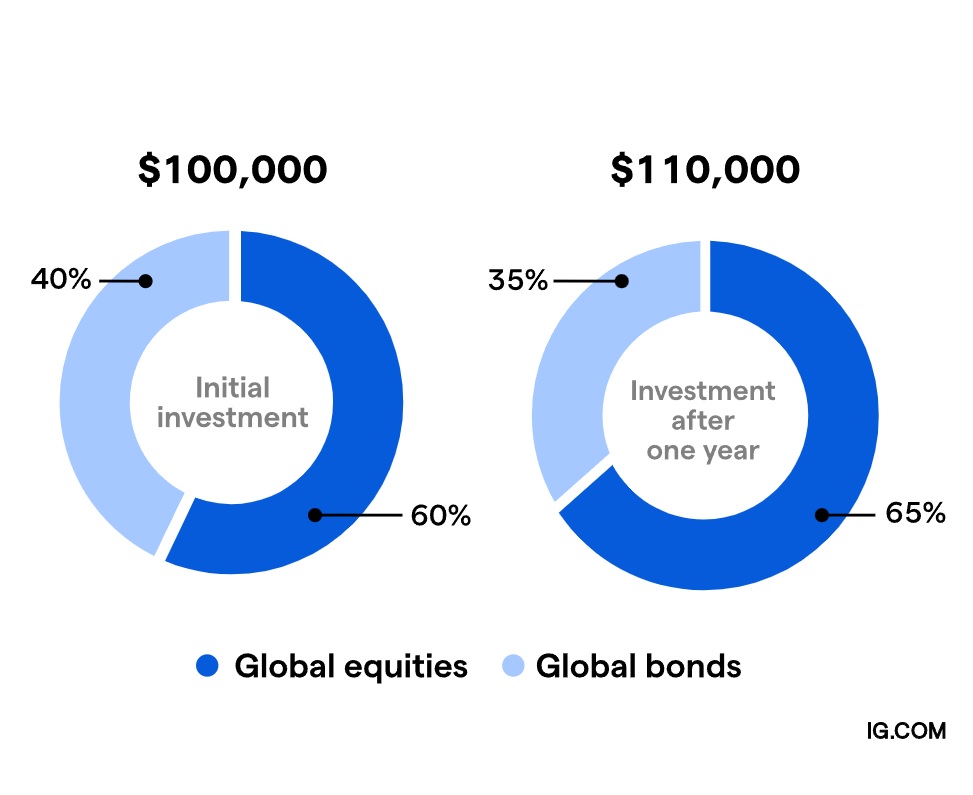

The asset allocation of a portfolio will undoubtably change as different securities will post differing returns over time. This’ll lead to a portfolio that looks somewhat different to the one which was originally deployed and could lead to a substantial change in risk. In the example below an investor starts with $100,000 in a portfolio of 60% in global equities and 40% in global bonds.

After a year, the portfolio is worth $111,000 with the gains being driven by a 21% rise in the global equity sleeve, while the global bond sleeve fell by 4%. The portfolio is up 11% over the year, but the fact that equities performed so well, and bonds slumped mean that equities will account for 65% of the portfolio, while bonds now only make up 35%.

Given that on aggregate, equities tend to be riskier than bonds, if you as the investor don’t change the composition of the portfolio after one year, you’ll, in theory, be in a riskier strategy with potentially more downside risk than you’d planned and may be able to tolerate. Hence, in this example, if you want to maintain the risk which you had upon starting the portfolio, you’d need to sell some of your equity gains and deploy them in a bond sleeve.

Of course, you’ll lose potential gains if the equity fund continues to rally strongly after year one. However, past performance is not an indication of future results, and the you’ll be taking on more risk than the year before, if no changes are made.

Can you be overdiversified?

Yes, overdiversifying is a very real risk for investors without a prudent investment strategy. While we have determined that having a diversified investment pot is crucial, gains can be whittled away if overdiversified. Over-diversification can occur when an incremental security added to a portfolio doesn’t increase the expected return and makes little to no difference in terms of reducing the portfolio’s risk.

While there’s no set cut-off point that determines whether a portfolio is overdiversified for equity portfolios, after around 30 stocks across various sectors are added, the portfolio begins to start losing its conviction. Yet, each portfolio should be assessed on an individual basis as market capitalisation, sector and valuation can play a significant role in volatility.

In terms of a multi-asset portfolio, you may find you’re overdiversified if you have multiple positions in different funds within the same geography or sector. For example, if you decide to hold three US growth funds in their portfolio, you may find you’re spreading yourself across too much of the same area.

The actual holding costs may rise if the fee structure for the funds is different. There’ll likely be a significant overlap in the granular holdings, given the area of investment is the same. Thus, the incremental risk reduction of holding another position in this example is virtually non-existent. To reap the full benefits of diversification, the additional position added should reduce the idiosyncratic risk of the portfolio.

Source : IG